Better Change Programs You to Take on Cellular Money 2025

11/09/2025 00:44

Articles

Find out about the process functions, the reasons why you you are going to consider using it and lots of pros and cons this service membership also provides. As with fundamental view deposits, mobile view deposits can also be bounce despite you will get verification. For example, the newest view will be came back should your photographs are illegible or while the take a look at issuer has lack of financing within their membership. Unfortunately, banks basically in addition to charge penalty costs to own returned monitors.

What’s Financing One Mobile deposit limitation?

If or not you’ve obtained an income, your own take a look at away from a pal, or an excellent cashier’s look at regarding the lender, there are a few ways to deposit the funds in the account. At the CNBC Discover, all of our mission would be to give our very own clients with a high-high quality service journalism and you can full consumer advice so they can generate advised choices with their currency. All the review is based on strict revealing because of the all of us out of specialist writers and you can writers having extensive experience with borrowing products. Since the storage months ends, the newest look at might be securely lost because of the shredding to quit delicate suggestions of being remodeled. Simply discarding the newest look at presents a security risk, as it can become retrieved and you can made use of fraudulently.

How would you like a cellular financial application?

Once you learn here isn’t a challenge who would need you to redeposit, shred the fresh endorsed take a look at to quit any possible abuse. We feel people will be able to make financial conclusion having confidence. Promoting a is actually a protection size that will help the bank make sure your as the rightful person for the money. It as well functions as the agreement to them that they would be to procedure the order.

Even with all tap-to-spend possibilities out there, report checks retreat’t entirely gone away. Your children you’ll receive a check regarding the mail as well as a birthday celebration otherwise getaway credit of grand-parents or members of the family. Children can still make them to possess region-go out work, grants, college reimbursements, or just in case someone favors pencil, papers, and you will a good checkbook more digital transfers. Banking companies tend to put everyday otherwise monthly put limitations thereby applying holds to the considerable amounts up to they be sure the fresh checks. The brand new app encrypts all of the research sent throughout the a cellular deposit, and therefore the info are scrambled to the a safe structure one’s extremely difficult to have hackers so you can decode.

Particular mobile banking software usually automatically populate the newest deposit count and you will other people mrbetlogin.com advice will demand one to by hand go into the number. Regardless ensure that the precise buck amount of the newest view is correct. The method begins with signing for the bank’s mobile app and you can selecting the put alternative. Utilizing the tool’s camera, users bring obvious pictures from both sides of your own take a look at. Best endorsement on the rear, normally with a trademark and you will “To possess Cellular Put Merely,” becomes necessary. When you are no-system is actually one hundred% protected to help you threats, mobile deposits have strong security measures which can be usually improving.

Or you may prefer to generate the name of one’s monetary business and/or your account number. Specific banks have a package you might tick one states “Take a look at here when the mobile deposit” or similar. Certain banking companies will get will let you consult a higher mobile deposit restrict, but normally, this is only offered so you can customers with a good financial history and you can a premier credit score. Try to contact your bank’s support service agency to inquire about increasing your mobile put restrict. If the lender provides mobile deposit, you’ll need to install its financial app from the Application Store (iOS) otherwise Yahoo Gamble Shop (Android). Create the newest software and make certain it’s current on the current adaptation to find the best capabilities and security measures.

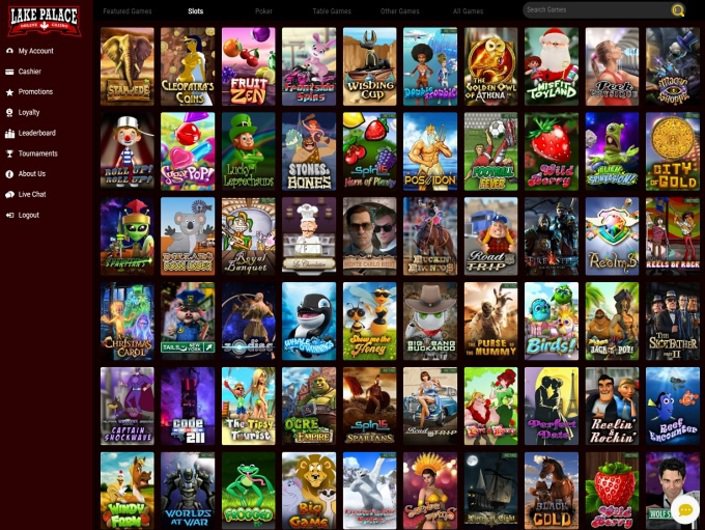

There are many banking companies and borrowing unions that offer mobile consider put since the an alternative. Should your standard bank doesn’t render it, you may also consider opening a merchant account someplace else. Besides cellular put take a look at has, here’s what things to think whenever altering banking institutions. Shell out because of the cellular casinos try internet casino sites in which participants deposit financing to their membership with their cell phones.

Dependent on your bank account type and also the period of their dating along with your financial institution, you have restrictions about precisely how much you could potentially deposit via mobile software daily, day, otherwise week. Lender put accounts, such as checking and you will savings, could be subject to acceptance. Put products and related characteristics are provided because of the JPMorgan Chase Lender, Letter.An excellent. Affiliate FDIC. Chase on the internet allows you to control your Pursue accounts, consider statements, display screen pastime, make ends meet or transfer fund safely from a single central place. To possess inquiries otherwise concerns, excite contact Pursue customer support otherwise write to us regarding the Pursue grievances and you can feedback. View the Chase Community Reinvestment Work Social Declare the bank’s newest CRA get or any other CRA-relevant guidance.

Be sure to ensure the place you would love the amount of money placed. When you yourself have multiple bank account that have a lender, you’ll be able to select your own appeal of a drop-down diet plan. 2nd, endorse the brand new consider you wish to deposit—as you do if you were placing it at the local branch. Money One people will be generate For Money You to cellular deposit lower than the signature on the back of the look at prior to taking photos and you will posting him or her from cellular app. Along with, their take a look at put suggestions and you will pictures won’t getting stored on the mobile phone.

If you’d like a convenient and you may safe put alternative, these casinos give a quick and simple solution because they ensure it is participants to pay for their profile without needing conventional banking. Even when spend by mobile is generally restricted to places simply, players will have to favor an alternative means for withdrawals. Cellular view deposit try a convenient element of numerous banks render you to definitely lets users to help you deposit checks in person due to a mobile financial app. As opposed to going to a part otherwise Atm, you might put inspections to your bank account with your mobile or equipment by simply capturing and you may submission pictures of one’s take a look at.

As the a frequenter away from Uk gambling enterprises, In my opinion Pay because of the Cellular is actually an enthusiastic underrated payment means. While it may sound a small old school than the financial solutions now, its simplicity and you will defense ensure it is the ideal choice for problems-100 percent free dumps. Don’t take too lightly the existing-fashioned options; they are able to still offer extreme pros. Trying to find a convenient online casino you to accepts a fast and you may safe treatment for financing your account playing with cell phone deposits?

Pursue QuickDeposit℠ are subject to deposit limitations and you may financing are generally offered by second working day. Find pursue.com/QuickDeposit or the Pursue Cellular application to have qualified mobiles, restrictions, terms, conditions and you can information. Within the today’s electronic day and age, the handiness of managing money features rather evolved. One particular innovation ‘s the ability to put checks having fun with mobile programs, changing the conventional financial feel. This article have a tendency to take you step-by-step through the fresh step-by-step procedure of placing checks easily right from your own mobile phone or tablet. Add a mobile consider put, you first have to sign the rear of it.

What you do try judge as there are no reason to do something skeptical otherwise you will need to mask the quantity otherwise source out of financing. Keeping track of your bank account the unauthorized transactions otherwise inaccuracies is important to suit your monetary security. Make sure the view isn’t damaged otherwise changed, because the financial institutions has rigorous rules concerning your reputation from monitors are placed. Before taking photos of your own take a look at, ensure that it is securely recommended. This means finalizing the back of the new take a look at and you may creating “To have Cellular Deposit Merely” under your trademark. Which approval is needed to make sure the look at can’t be transferred once again once they’s already been canned.

Banking legislation require this informative article and you may, without it, their cellular look at deposit could be denied. That’s while the mobile view deposit element in this apps fundamentally also provides a person-friendly sense, even for lowest-tech people. If you’re able to work the digital camera on the cellular phone or tablet therefore know how to down load an app, you might fool around with mobile take a look at deposit. Which financial allows you with cellular look at put constraints away from $2,five hundred each day and you can $5,100000 30 days. Monitors is actually even rarer than simply cash now, inside the a time when plastic material cards plus option currencies appreciate the fresh spotlight.